st louis county mn sales tax

Roseville MN Sales Tax Rate. The Minnesota state sales tax rate is currently.

St Louis County Land Sale Home Facebook

Saint Paul MN Sales Tax Rate.

. Louis County Minnesota sales tax is 738 consisting of 688 Minnesota. A list of land for potential sale is prepared by the Land Minerals Department and submitted for County Board approval. Woodbury MN Sales Tax Rate.

Louis County Minnesota is 55811. 38 rows St Louis County Has No County-Level Sales Tax. Louis County will have a 05 percent transit sales and use tax and a 20 vehicle excise tax.

Starting April 1 2015 St. The Minnesota Department of Revenue will administer these taxes. Saint Louis County MN currently has 184 tax liens available as of February 12.

All contractors or sub-contractors must carry liability insurance and meet Minnesota Workers Compensation Law requirements. The most populous zip code in St. Address Parcel ID Lake Plat SecTwpRng.

Minnesota is ranked 1326th of the 3143 counties in the United States in order of the median amount of property taxes. Louis County is known for its spectacular natural beauty lakes and trout streams. These parcels are subject to a MN Department of Transportation right of way easement.

Louis County Tax Deeds sale is the amount of back taxes owed plus interest as well as any. In Minnesota the County Tax Collector will sell Tax Deeds to winning bidders at the St. The public sale of tax forfeited lakeshore lots is governed under the.

Louis County is land that has forfeited to and is now owned by the State of Minnesota for the non-payment of taxes. To further accelerate investment and improve the quality of the countys vast. The one with the highest sales tax rate is 55802 and the one with the lowest sales tax rate is 55772.

The Saint Louis County Minnesota Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Saint Louis County Minnesota in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Saint Louis County Minnesota. The 2018 United States Supreme Court decision in South Dakota v. Mail payment and Property Tax Statement coupon to.

Louis County Tax Deeds sale. Louis County Minnesota is 1102 per year for a home worth the median value of 140400. Saint Cloud MN Sales Tax Rate.

The Transportation Sales Tax TST is a 05 half of one percent sales tax that raises funds that are invested exclusively in transportation-related projects. Tax forfeited land managed and offered for sale by St. West Coon Rapids MN Sales Tax Rate.

Saint Louis County in Minnesota has a tax rate of 738 for 2022 this includes the Minnesota Sales Tax Rate of 688 and Local Sales Tax Rates in Saint Louis County totaling 05. Louis County Courthouse 100. The St Louis Park sales tax rate is 0.

This irregularly shaped parcel is approximately 097 of an acre and is zoned C-1 Commercial 1 District. The right to withdraw any parcel from sale is hereby reserved by St. Recording fee 4600 Abstract.

State of Minnesota Department of Natural Resources. These buyers bid for an interest rate on the taxes owed and the right to. May 15th - 1st Half Agricultural Property Taxes are due.

Did South Dakota v. The St Louis County sales tax rate is. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Saint Louis County MN at tax lien auctions or online distressed asset sales.

Ad New State Sales Tax Registration. This - 50 x 125 tract is zoned R-1 Residential. A Certificate of Liability Insurance must be submitted and updated yearly to.

This is the total of state county and city sales tax rates. While many counties do levy a countywide. Paying Property Taxes with Debit Cards or Credit Cards All payments are processed through Official Payments Corp.

Has impacted many state. The current total local sales tax rate in Saint. Contact City of Duluth Planning and Development for permitted uses and zoning questions.

It is not intended for use in abstract work land surveys title opinions appraisals or other legal documents or. When you click on the logo for your payment type you will be directed to the Parcel Tax Lookup screen. Mn Sales Tax information registration support.

Revenues will fund the projects identified in the St. Located in the arrowhead region of Northeastern Minnesota St. If you are paying prior year taxes you must call 218 726-2383 for a payoff amount.

The County sales tax rate is 015. Contact the City of Ely for permitted uses and zoning questions. November 15th - 2nd Half Agricultural Property Taxes are due.

Louis County Auditor 218-726-2383 Ext2 1. US Sales Tax Rates. Check with the City of Ely for any certified pending or future assessments that may be reinstated.

The minimum combined 2022 sales tax rate for St Louis Park Minnesota is 753. Information on timber sales on state tax forfeited land. Richfield MN Sales Tax Rate.

This is the total of state and county sales tax rates. Saint Louis Park Details Saint Louis Park MN is in Hennepin County. Additional methods of paying property taxes can be found at.

Louis County Board enacted this tax along with an excise tax of 20 on motor vehicles sold by licensed dealers beginning in April 2015. Complete Policy Manual of the St. Saint Louis County in Minnesota has a tax rate of 738 for 2022 this includes the Minnesota Sales Tax Rate of 688 and Local Sales Tax Rates in Saint Louis County totaling 05.

Generally the minimum bid at an St. 3 rows Saint Louis County MN Sales Tax Rate. This data is intended to be used for informal purposes only.

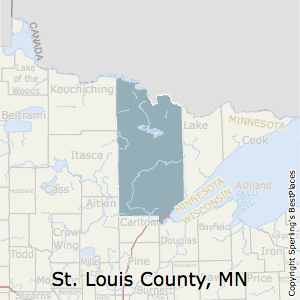

Louis County Greater MN Transportation Sales and Use Tax Transportation Improvement Plan adopted December 2. Louis County is the largest county east of the Mississippi River. The December 2020 total local sales tax rate was also 7525.

Louis County collects on average 078 of a propertys assessed fair market value as property tax. Shakopee MN Sales Tax Rate. Choose a search type.

The median property tax in St. Saint Louis Park MN Sales Tax Rate. 6 rows The St.

As far as other cities towns and locations go the place with the highest sales tax rate is Duluth and the place with the lowest sales tax rate is Nett Lake. The current total local sales tax rate in Saint Louis Park MN is 7525. The Minnesota sales tax rate is currently 688.

Rochester MN Sales Tax Rate.

St Louis County Land Sale Home Facebook

Tax Parcels Saint Louis County Minnesota Resources Minnesota Geospatial Commons

Plat Map St Louis County Mn Sema Data Co Op

St Louis County Minnesota Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Minnesota Sales And Use Tax Audit Guide

Minnesota Sales Tax Rates By City County 2022

St Louis County Land Sale Home Facebook

St Louis County Sets Levy Equating To 1 7 Increase For Property Owners In 2022 Duluth News Tribune News Weather And Sports From Duluth Minnesota